What Is Amigo Insurance?

Amigo Insurance is a specialized provider that has earned a reputation for affordable, community-oriented auto insurance services, especially among Hispanic and bilingual communities in the U.S. It’s more than just a car insurance company—Amigo is known for combining low prices with a personal touch.

Founded to bridge the gap in insurance access for underserved populations, Amigo’s mission revolves around providing simplified, understandable coverage. Whether you’re a new driver, high-risk driver, or looking to switch from an overpriced provider, Amigo Insurance is often an ideal option.

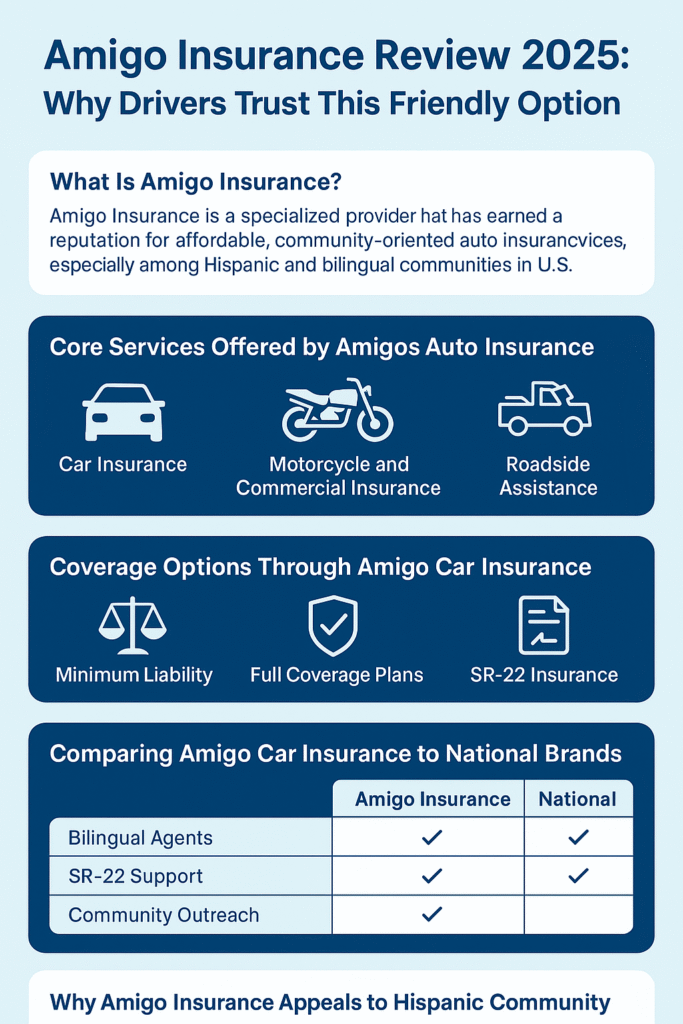

Core Services Offered by Amigos Auto Insurance

Amigos Auto Insurance offers a wide array of services aimed at covering the modern motorist’s needs.

Car Insurance

This includes both state-mandated liability policies and optional full coverage, tailored for individuals with various driving records.

Motorcycle and Commercial Insurance

If you operate a business or own a motorcycle, Amigo offers specialized policies that comply with legal standards while remaining cost-effective.

Roadside Assistance

24/7 roadside support adds peace of mind to every policy, especially useful for long-distance drivers or those commuting daily.

Coverage Options Through Amigo Car Insurance

Amigo Car Insurance makes it easy to select the right type of coverage.

Minimum Liability

This meets state legal requirements and is a popular choice for budget-conscious drivers or those with older vehicles.

Full Coverage Plans

For those needing protection against theft, vandalism, or natural disasters, full coverage includes comprehensive and collision benefits.

SR-22 Insurance

Amigo helps drivers who need SR-22 filings, offering fast approval and minimal paperwork—even for high-risk customers.

Read Also : Why Fiesta Insurance is a Smart Choice in 2025

Why Amigo Insurance Appeals to the Hispanic Community

One of Amigo’s most defining traits is its deep connection with Hispanic families and individuals across America.

- Language Support: Services and documents are available in Spanish, ensuring clarity for native speakers.

- Cultural Sensitivity: Amigo’s staff often mirrors the demographics of its community, fostering trust and understanding.

- Community Involvement: Local events, sponsorships, and educational seminars keep Amigo present and invested in the neighborhoods it serves.

Comparing Amigo Car Insurance to National Brands

How does Amigo stack up against competitors like Geico or Progressive?

| Feature | Amigo Insurance | National Brands |

|---|---|---|

| Bilingual Agents | ✅ Yes | ❌ Limited |

| SR-22 Support | ✅ Available | ✅ Yes |

| Community Outreach | ✅ Strong | ❌ Minimal |

| Personalized Service | ✅ Local Agents | ❌ Centralized Online |

| Digital Convenience | ✅ Yes | ✅ Yes |

Amigo’s hyperlocal service model often leads to more responsive customer service and better rates for those in targeted areas.

Customer Service at Amigo Insurance Locations

Customers have the option to visit in person, call in, or use the online platform. Amigo’s agents are trained to walk clients through every step of the process without using intimidating insurance jargon.

Most locations have bilingual staff, making the experience smooth and reassuring. Wait times are generally short, and transactions—whether a quote or a claim—are completed quickly.

Pros and Cons of Choosing Amigos Auto Insurance

✅ Pros:

- Affordable monthly rates

- Bilingual service

- SR-22 friendly

- Local and personalized support

❌ Cons:

- May not be available in all U.S. states

- Limited bundling with non-auto insurance types

Filing Claims Through Amigo Insurance

Amigo simplifies the process of filing an auto insurance claim.

Steps:

- Call or visit the nearest office.

- Submit a written or digital statement with any photos or police reports.

- Receive instructions and timeline for repair or settlement.

- Monitor status via app or agent.

Claims are typically processed within 7–10 business days.

Amigo Insurance Pricing and Discounts

Pricing is determined by several factors: age, driving history, zip code, and vehicle type.

Popular Discounts Include:

- Safe driver discounts

- Multi-car discounts

- Referral incentives

- Pay-in-full savings

Rates from Amigo Insurance are usually 10–25% lower than national averages for comparable plans.

Reviews and Testimonials from Real Customers

Customers rave about the friendliness and transparency of Amigo agents. On Google and Yelp, Amigo Insurance branches maintain average ratings of 4.2 to 4.6 stars, with many testimonials mentioning:

- Quick and helpful claims handling

- Affordable SR-22 policies

- Outstanding bilingual service

Locations and Online Access to Amigo Services

Amigo Insurance operates in several key U.S. markets, including Texas, Illinois, California, and Florida.

Customers can:

- Get quotes online

- Make payments through a secure portal

- Download policy documents digitally

How to Get a Quote from Amigos Auto Insurance

You can get a quote in three easy ways:

- Visit a local office – Ideal for personalized service.

- Call their hotline – Speak directly with a bilingual agent.

- Use the website – Fast and convenient for self-service.

Read Also : Why Fiesta Insurance is a Smart Choice in 2025

Amigo’s Mobile App and Digital Tools

The app allows users to:

- View policy information

- File and track claims

- Contact customer support

- Set up reminders for payments or renewals

Who Should Consider Amigo Car Insurance?

Amigo is ideal for:

- First-time drivers

- High-risk drivers needing SR-22

- Spanish-speaking households

- Budget-conscious families

Amigo’s Role in Financial Education & Community Events

Amigo regularly hosts:

- Insurance literacy workshops

- Back-to-school drives

- Local sponsorships for youth sports and small businesses

Their mission extends beyond selling policies—they aim to uplift their neighborhoods.

Frequently Asked Questions (FAQs)

1. Is Amigo Insurance only for Spanish-speaking drivers?

No, Amigo serves everyone, though it’s especially friendly to bilingual communities.

2. Can I get SR-22 insurance through Amigo?

Yes, SR-22 filings are one of their specialties.

3. How fast can I get a quote?

Quotes are available instantly online or within 10 minutes in-person.

4. What states is Amigo Insurance available in?

Primarily in Texas, Illinois, California, and Florida, with expanding locations.

5. Can I manage my policy online?

Yes, through their website or mobile app.

6. Do they offer roadside assistance?

Yes, it can be added to most policies.

Conclusion: Is Amigo Insurance the Right Fit for You?

If you’re looking for reliable, affordable coverage with a personal touch, Amigo Insurance is a great choice—especially for Spanish-speaking or high-risk drivers. With excellent reviews, bilingual service, flexible plans, and real community support, it’s no wonder so many people trust Amigo for their insurance needs.

[…] Read Also : Amigo Insurance Review 2025: Why Drivers Trust This Friendly Option […]

[…] Read Also : Amigo Insurance Review 2025: Why Drivers Trust This Friendly Option […]

[…] Read Also : Amigo Insurance Review 2025: Why Drivers Trust This Friendly Option […]